Introduction and Objective of Companies (Amendment) Act, 2017

The Companies Amendment bill, 2017 was passed by Lok Sabha and Rajya Sabha on 27th July, 2017 and 19th December, 2017 respectively. The Bill received President’s assent on 03rd January, 2018 and becomes the Companies (Amendment) Act, 2017.

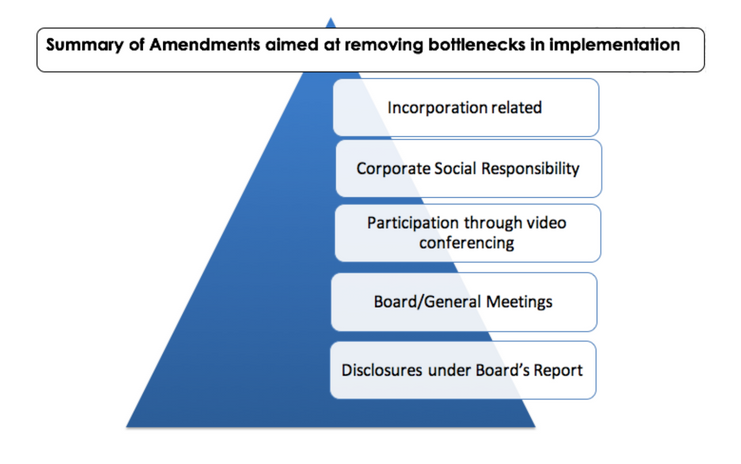

OBJECTIVE:

- Simplification of compliances

- Facilitating ease of doing business

- Harmonization with other laws

- Rectifying omissions and inconsistencies in the Act

- Strengthen Corporate Governance Standards

- Strict action against defaulting companies

| Section No | Amendment | Impact |

|

Section 4(5) Name Reservation |

· In case of reservation of name for incorporation, the name so reserved shall be valid for 20 days from date of the approval instead of 60 days from the date of application.

· In case of change in name by an existing company, name reserved by the ROC shall be valid for 60 days from the date of approval.

|

The concerns of professionals regarding timelines for reservation of name from the date of approval instead of application has been addressed.

|

|

Section 7- Incorporation of Company

|

At the time of incorporation of the company, self-attested declaration by each subscriber will be required to be attached instead of a notarized affidavit on a stamp paper.

|

This will ease the additional documentary burden and avoid delay in the incorporation process.

|

|

Section 12- Registered office of company

|

• The companies will be required to have registered office within 30 days of its incorporation rather than from the 15th day of its incorporation.

• The period of reporting notice of change of the situation of the registered office to the Registrar will be increased from 15 to 30 days.

|

In case of change of the registered office of a company, there was concerns that the period of fifteen days is too short as certain documents like lease deeds, rent agreements and other related documents are required to be submitted besides various approvals that may have to be obtained. Accordingly to address the concerns, the period is increased to thirty days. |

|

Section 21- Authentication of documents, proceedings and contracts |

Apart from KMP and any officer of the company, an employee can also be authorized to authenticate documents on behalf of the company. |

Allowing authentication of documents by ‘any employee’ is reflection of ‘overstretched’ liberalization. |

|

Section 54- Issue of Sweat Equity Shares

|

The Companies can issue sweat equity shares at any time after registration of the company. Currently such shares can be issued only after the expiry of one year from the date of commencement of business. |

It can be used by startups to retain potential talent.

|

|

Section 135- Corporate Social Responsibility |

•Eligibility criteria for the purpose of constituting the corporate social responsibility committee and incurring expenditure towards CSR will be calculated based on immediately preceding financial year rather than “preceding three financial years”.

• In case of companies which are not required to appoint an independent director, shall have two or more directors in its Corporate Social Responsibility Committee.

• Empowers Central Government to prescribe sums which shall not be included for calculating ‘net profit’ of a company under section 135.

|

Through this amendment, more clarity is provided in relation to calculation of net profit and utilization of CSR contribution.

|

|

Section 139- Appointment of Auditors

|

The requirement related to ratification of appointment of auditors by members at every annual general meeting is omitted.

|

Provision of ratification was defeating the objective of giving five year term to the auditors. Further there was no clarity in case the shareholders choose not to ratify the auditor’s appointment as per Section 139. |

|

Section 110- Postal Ballot

|

The items which are to be transacted by postal ballot only may now be transacted by e-voting also. It implies for relaxation in the items to be transacted by postal ballot only.

|

• Enable maximum shareholders to participate in the meeting. • Saving the cost of conducting postal ballot & general meeting. |

|

Section173(2)- Participation through video-conferencing

|

Currently, a director can’t participate through video conferencing in the Board meeting likely to discuss restricted items.

Now, as per Amendment Act, 2017 if physical quorum of director is present, any other director may participate through video conferencing or other audio visual means to discuss restricted items as well.

|

Provides relief to non-resident directors to participate in the discussion and voting on important matters like approval of financial statements etc. without travelling to the place of meeting.

|

|

Section 134(1)-Financial Statement, Board’s Report. Etc.

|

Earlier, Chief Executive officer was required to sign the Financial statements only if he is a director. Now, whether CEO is a director or not, requires mandatorily to sign the financial statements and other related documents. |

Since Chief Executive Officer (CEO) is a Key Managerial Personnel and responsible for the overall management of the company, he should sign the Financial Statement even if he is not director in the Company.

|

|

Section 134(3)(a)-

|

The requirement of extract of Annual return (Form MGT-9) being part of Board’s report is not required whereas the web address/ link is to be disclosed in the Board’s Report.

|

Likely to reduce certain unproductive efforts. |

|

Section 134(3A)

|

A new sub-section is to be inserted which provides for prescribing an abridged Board’s report for One Person Company or small company.

|

With a view to facilitate ease of doing business and for reducing the burden of One Person Company and Small Company, the Central Government is empowered to prescribe an abridged form of Annual Return. |